June 20, 2011 - Provided by Bullion Weekly from www.thebulliondesk.com

| BULLISH | BEARISH | OUTLOOK | |||

|

Greek debt & contagion. Inflation. QE3. |

Stronger dollar. Potential for risk reduction. End of QE2. |

Short Term: Medium Term: Long Term: |

Consolidate Climb back to Extend gains |

$1,500-1,555 $1,575 $1,570-1,630 |

|

Markets have a lot of questions on the outlook for the US economy and many are hoping to get answers from Bernanke's press conference, which will follow the FOMC statement on Wednesday. We expect him to confirm the reinvestment of maturing assets, whilst leaving the o/n rate unchanged. Investors will also be keen to find out if Bernanke's outlook for US GDP has altered at all. In Europe, crisis resolution has come to a standstill until the Greek parliament can ratify the €28bn of spending cuts in exchange for the next €12bn tranche of original bailout package. If passed, it will buy Europe some respite, although we doubt it will last long as the second Greek bailout then needs to be negotiated.

This week we also have a host of data - bad figures could confirm that the global economic 'soft patch' has extended into June. All in all, we are expecting a volatile week, which will be driven by the risk on/risk off approach towards markets and movements in the dollar.

China looks set to play a pivotal role in the global macro-economic recovery in the coming weeks, despite recent concerns over the pace of China's own expansion and the efforts of the Peoples Bank to prevent an asset/property bubble by making a further increase in its reserve ratio requirement.

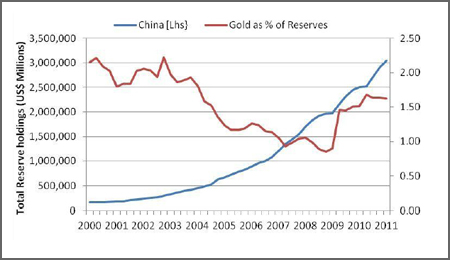

The accompanying chart shows the increasing expansion of China's fiscal reserves which currently stand in excess of $3-trillion. But, while Chinese gold demand has enjoyed strong growth and consolidation within the mining sector has led the country to become the largest global producer, the country's official holdings remain little changed since the Peoples Bank announced a 454-tonne increase during the second quarter of 2009 to 1,054.1 tonnes. Also the proportion of gold within its holdings remains low at 1.6% and with China's total reserves increasing by around 3% per quarter the central bank will need to add around 35 tonnes of gold per quarter or 140 tonnes per year just to maintain that current percentage.

China could also play a role with the current debt situation facing Greece and the EU, potentially offering a lifeline which would also serve to protect its own "vital" interests, which could be jeopardized should Greece default, according to China's Vice Foreign Minister Fu Ying.

China has already made efforts to help Europe by buying more European debt and encouraging bilateral trade, but with China believed to hold around a quarter of reserves in euro-denominated assets there is scope for China to take on more European assets and government debt.

Whatever the outcome a decision on how to keep Greece afloat needs to be reached soon for fear of triggering Europe's very own "Lehman moment," which has the potential to trigger another rout of risk sentiment and potentially tip the delicately balanced world economic expansion back into recession.

Gold closed positively last week, having bounced off support from the bottom of the long-term up-channel. As such, the metal has opened back in its recent trading range. The stochastics and RSI are very much neutral, whilst the metal is consolidating on support from the 5WMA. Our view on gold is as follows: having bounced off the bottom of the up-channel last week prices could look to challenge overhead resistance. However, whilst it remains in this well subscribed four week trading range ($1,503-$1,544), we will remain neutral.

We would only look to turn positive on a move over $1,544, but conversely would also be happy to turn negative on a close under $1,522. In the medium-to-long term, however, we remain positive, based on gold still trading inside the bullish up-channel ($1,431-$1,665).

Silver closed in a long legged Doji formation last week. This week it has opened higher, but then proceeded to come off again. The metal formed a new symmetrical triangle formation ($38.11-$34.89) last week, and has support from a tentative up-trendline ($34.66). The RSI is neutral-to-negative, whilst the stochastics remain bearish. Silver has resistance from the 5WMA, and support from the 50WMA.

Our overall stance has not changed - we remain neutral in the short term. We would look to turn bearish on silver on a close under $34.89-$34.66. Conversely we would not be opposed to turning mildly bullish on a close over $36.30 (5WMA). Medium-term, we are still bullish, but note that a close under $34.66 would turn us negative as the prices could then have to move back to $31.25-$27.00 to test long term support.

"The Greek debt situation certainly has the potential to create havoc with the European banking system," said Neil Phillips, a fund manager at BlueBay Asset Management Plc in London. "A Greek default and the ramifications of that would be too ghastly for Europe and the European banking system to contemplate right now."

Dollar Index

Two weeks ago we noted early signs of a rebound and that has indeed unfolded. Prices held the 78.6% Fibonacci retracement line and having avoided testing the early May low, the rebound looks constructive. Clearance of the previous peak at 76.37 would be sign of strength. Dollar strength is likely weigh on bullion prices in the short term. |

Gold & Silver ETFs

ETF investors slightly increased their exposure in gold last week – adding 8.2 tonnes, some 0.4 percent. Whereas in silver the selling continued with the combine position dropping 257 tonnes, some 1.8 percent. So gold continues to be more in favour than silver, which is confirmed by the pick-up in the gold:silver ratio. |

Funds

Fund investors have cut their net long position in silver in recent weeks. It last peaked at 40,937 contracts, but has fallen to 16,587 contracts. The net long gold position had climbed in recent weeks by 34,105 contracts, but it dropped last week by 7,013 contracts as longs liquidated and shorts got shorter. This suggests the market is not overly bullish. |

Gold : Silver Ratio

The gold/silver ratio has been consolidating in triangle. The ratio has climbed through the top of the triangle so this could be a continuation pattern. So far it has lacked the energy to push up through the former peak at 45.75. A break higher would suggest silver prices fall at a faster rate than gold and that would probably mean general long liquidation in bullion. |

Gold and silver prices are holding up well and given the potential for another financial crisis if governments and central banks cannot get a handle on the Greek debt situation, we feel bullion will generally remain sought after.

However, should the broader markets start to run scared, then we would be on high alert for a sell-off across markets as risk is taken off the table. In this scenario we would expect gold and silver prices to fall as well – at least initially. Conversely, given the likelihood of massive fall-out should Greece default, we feel the powers-that-be will do all they can to prevent the Greek debt situation from boiling over. As such, there may be room for some reduction in demand for safe-haven investments, should the EU finance ministers find an intermediate solution to Greece's funding issue.

As such we feel there is risk on the downside in the short-to-medium term, but longer term we remain bullish for gold and expect dips to attract good volume buying. Longer term we also feel that the dollar will struggle, given the US debt and deficit situations and that is likely to underpin the underlying uptrend in bullion prices.

Terms & Conditions

The Terms and Conditions for this service are available below:

http://premium.basemetals.com/content/html/FMTermsandConditionsforonlineServices.html

Representations and Liability

1. Fastmarkets represents that:

(i) It will supply the Services in a professional way, using the care that can be reasonably expected for this type of business, and in accordance with the practices and policies which are commonly applicable in the information services industry:

(ii) it is duly empowered to supply the Information and Service(s) to the Client for the purposes specified in this Agreement and that the Service(s) and its use by the Client as specified in this Agreement will not infringe any intellectual property rights of any third party.

2. Although Fastmarkets will use all reasonable endeavours to ensure the accuracy and reliability of the Services, neither Fastmarkets, the Data Sources, or any third-party provider will be liable to the Client (or any third party) for direct, indirect or consequential loss or damage, including but not limited to loss of data, trading or other economic losses, arising out of any reliance on the accuracy of the Information (including but not limited to data, news and opinions) contained in the Service(s) or resulting in any way from the supply (or failure of supply) of the Services. However, Fastmarkets accepts liability for physical loss or damage to the Site caused by its negligence or wilful misconduct.

3. Except as expressly stated in this agreement, all express or implied conditions, warranties or undertakings, whether oral or in writing, in law or in fact, including warranties as to satisfactory quality and fitness for a particular purpose, are excluded.

4. The Client will indemnify Fastmarkets against any loss, damage or cost in connection with any claim or action that may be brought by any third party against Fastmarkets relating to any misuse of the Services by the Client.

5. To the extent permitted by law, under no circumstances will Fastmarkets' liability under this Agreement exceed the Service Fees paid to Fastmarkets by the Client, regardless of the cause or form of action.

Privacy Policy

The Fastmarkets Ltd Privacy Policy is available below:

http://premium.basemetals.com/content/html/Privacy_Policy.html

This Bullion Weekly is presented by an unaffiliated third party and Interactive Brokers LLC does not create the content of these presentations. You should review the contents of each presentation and make your own judgment as to whether the content is appropriate for you. Interactive Brokers LLC does not provide recommendations or advice. This presentation is not an advertisement or solicitation for new customers. It is intended only as an educational presentation.